Sportradar Paying Nothing to Acquire IMG Arena Betting Assets

Sportradar (NASDAQ: SRAD) announced on Wednesday that it is purchasing IMG Arena and its sports betting assets from Endeavor Group Holdings for virtually no expense to the purchaser.

According to the agreement, Sportradar secures a payment of $125 million while Endeavor commits $100 million in cash advances “to specific sports rightsholders.” The deal, which Sportradar revealed alongside its fourth-quarter outcomes, is expected to finalize in the fourth quarter of this year.

The buyer located in Switzerland stated that the acquisition will enhance revenue and will be accretive to cash flow and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). It further strengthens Sportradar’s presence in various sports in which it is already involved.

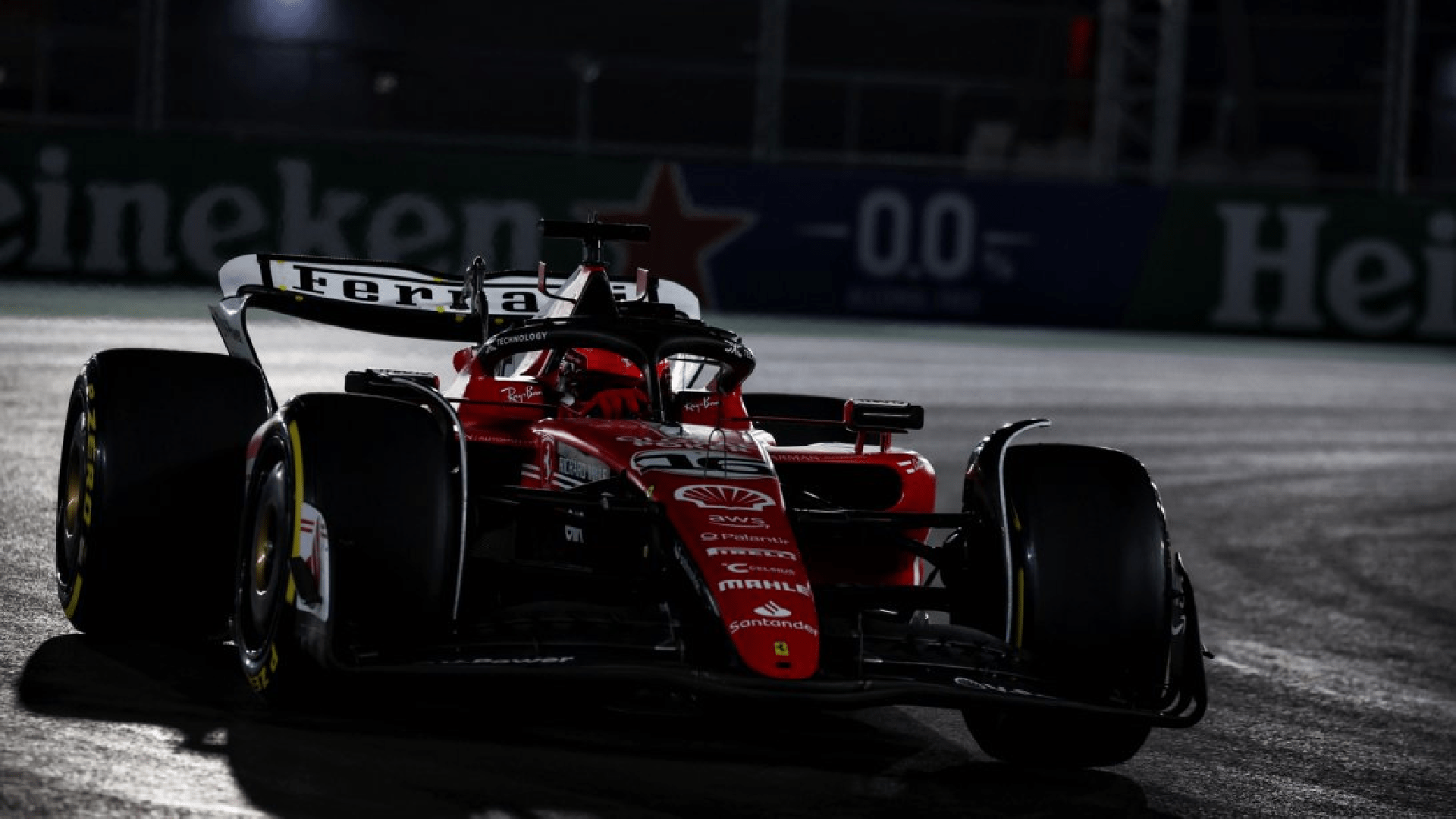

“Basketball, soccer, and tennis account for approximately 70% of the rights which are the top three most bet on global sports, complementing our existing sports portfolio,” said the buyer in a statement.

Through this agreement, Sportradar incorporates 70 rightsholders, covering 39,000 data points and 30,000 streaming events across 14 different sports.

“Prominent global properties include Wimbledon, U.S. Open, Roland-Garros, Major League Soccer, EuroLeague basketball and PGA Tour. Combined with existing tennis rights, Sportradar will now hold betting rights to three of the four Grand Slams,” said the buyer.

Sportradar Purchase Closes Discussion on IMG Arena's Future

The future of IMG Arena has sparked industry speculation following Endeavor CEO Ari Emanuel, OpenBet CEO Jordan Levin, and others paying $450 million to acquire OpenBet from Endeavor in connection with the UFC parent's go-private deal with venture capital firm Silver Lake. The acquisition highlighted that between IMG Arena and OpenBet, the latter was the more valuable asset.

After that deal, it became widely recognized that IMG Arena was for sale; however, several analysts pointed out that it was improbable for Sportradar and competing Genius Sports (NYSE: GENI) — the leading entities in the sports betting data sector — to make bids for the former Endeavor division.

Sportradar has never openly stated its lack of interest in IMG Arena, and it’s conceivable that the opportunity to acquire lucrative data rights at virtually no expense was an irresistible offer for the purchaser.

“The unique structure of this transaction will further strengthen Sportradar’s already robust balance sheet and enhance its significant liquidity position, allowing for continued strategic investments and opportunities for incremental shareholder returns, including an anticipated acceleration on the pace of its existing buyback program,” said the buyer in a statement.

Might an OpenBet transaction happen soon?

Sportradar’s purchase of IMG Arena might fuel rumors that an agreement for OpenBet is on the horizon, but the list of potential buyers for OpenBet is short, and there’s been no recent discussion to support that idea.

Sportradar investors seemingly reacted positively to the news and the data provider's fourth-quarter results, as the stock surged nearly 13% with trading volume exceeding three times the daily average in after-hours trading.

In 2024, the firm’s EBITDA and revenue jumped by 33% and 26%, respectively. Its cash reserves increased to $380.26 million from $314.7 million at the conclusion of 2023.