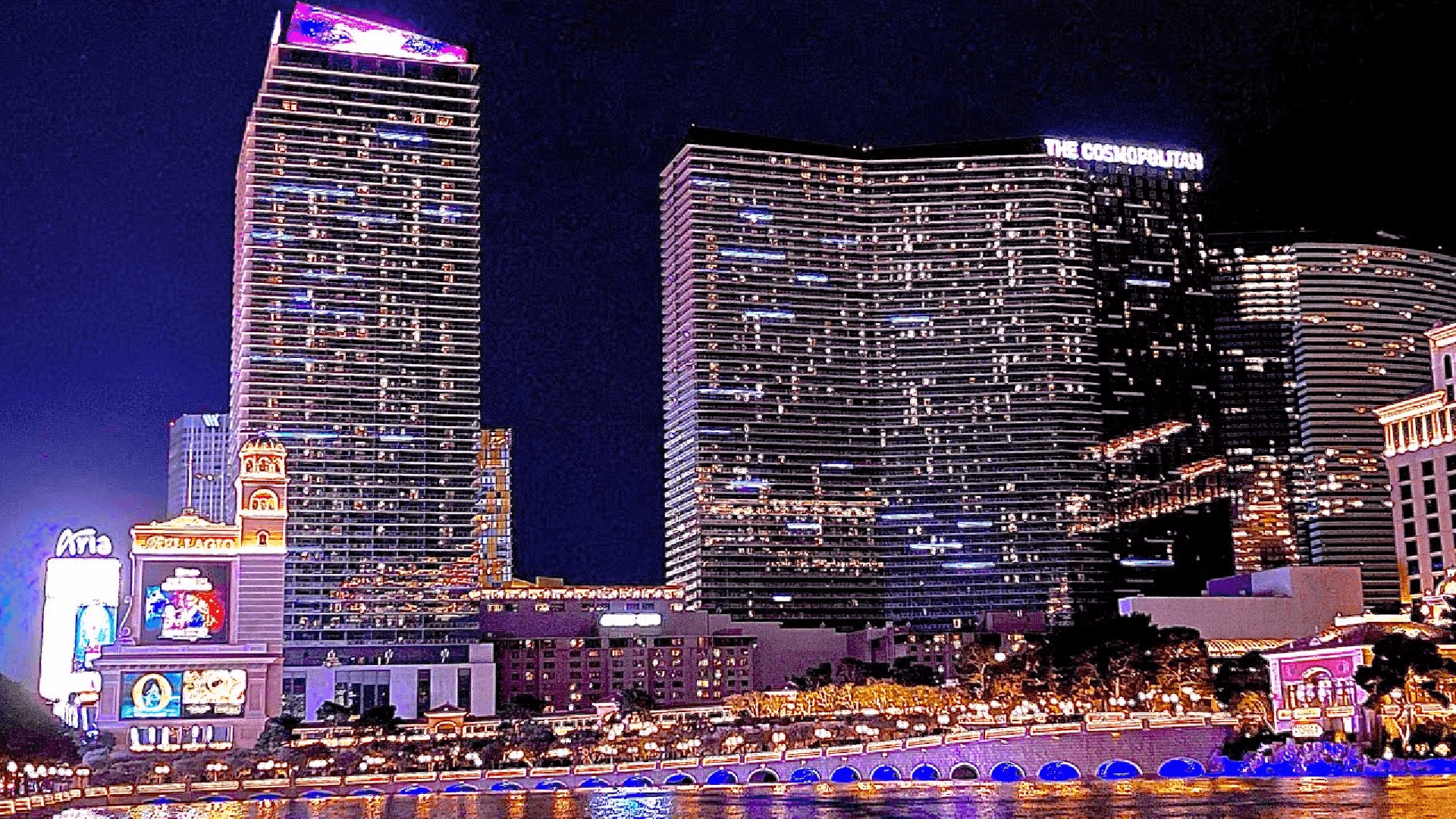

MGM Continues Buying Back Shares as BetMGM Revenue Soars

Today, MGM Resorts International (NYSE: MGM) presented its third-quarter earnings, emphasizing to investors the company's continued share repurchase initiatives and revenue expansion at its BetMGM division.

The Bellagio operator reported record consolidated net revenue of $4.2 billion for the September quarter, a 5% year-over-year growth, aided by its MGM China unit. A year ago, adjusted earnings per share were 64 cents, but now they are 54 cents.

MGM reported that its third-quarter Strip revenue increased 1% to $2.1 billion as adjusted earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs (EBITDAR) increased to $731 million from $714 million, despite analysts pointing out difficult year-over-year comparisons for some Las Vegas Strip operators. The biggest operator on the Strip is MGM.

As adjusted EBITDAR increased 2% to $300 million from $293 million, MGM reported that sales at its regional casinos increased to $952 million from $925 million, possibly easing worries about weakness in some regional markets.

BetMGM Makes Significant Progress

Although it currently lags behind competitors like FanDuel and DraftKings (NASDAQ: DKNG) in terms of market share, BetMGM, a 50/50 joint venture between the gaming behemoth and Entain Plc (OTC: GMVHY), is improving, as seen in the July–September period.

"Accelerating growth at BetMGM with record 3Q net revenues increasing nearly 20% year-over-year, more than doubling the revenue growth achieved in 2Q,” said the gaming company in a statement.

T he US sports betting market is virtually a duopoly controlled by FanDuel and DraftKings, but iGaming is a more open market with larger margins and possibilities for profit. BetMGM is redoubling its efforts to gain market share in T hat sector, which could have long-term benefits.

Because of its potential for long-term growth, iGaming is essential for operators like BetMGM. Only seven states currently allow that type of gambling: Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, Rhode Island, and West Virginia. However, as states look for new ways to make money, that number is predicted to rise in the years to come.

Buybacks Are Still Included in the MGM Playbook

MGM has been one of the gaming industry's most devoted purchasers of its own stock for a number of years, and the third quarter was no exception.

“During the quarter, we returned over $300 million to shareholders through share repurchases, bringing our year-to-date total to approximately $1.3 billion,” said CFO Jonathan Halkyard in the press release.

Through share repurchases, the gaming company has lowered the number of outstanding shares by 40% since 2021. With $944 million in free cash flow at the end of the third quarter, MGM's comparatively low debt and strong liquidity support continued share buybacks.